Bitcoin to $200K? Trump's Dollar Devaluation Plan Could Ignite Crypto's Reserve Currency Takeover News ETHNews

Isai Alexei

April 9, 2025

Market uncertainty dominates as investors parse the implications of proposed U.S. tariffs under the Trump administration. ETHNews analysts debate whether these measures are tactical negotiations or long-term policy shifts. Amid the noise, one clear takeaway emerges: the administration seeks a weaker U.S. dollar, even if it risks diminishing its global reserve currency status.

Steve Miran, chair of the White House Council of Economic Advisers, outlined this stance in a recent speech. He argued that the dollar’s reserve role has distorted currency markets, widened trade deficits, and harmed U.S. manufacturing. “Demand for dollars has kept currency markets distorted,” Miran stated, emphasizing that a softer dollar could revive competitiveness.

A weaker dollar makes U.S. exports cheaper abroad but risks inflation and reduced purchasing power domestically. It also challenges the dollar’s dominance in global trade—a system in place since World War II.

In the near term, a declining dollar could boost Bitcoin

Over the past five years, Bitcoin has shown a negative correlation (-0.4 to -0.8) with the U.S. Dollar Index (DXY). When the dollar weakens, Bitcoin often rises. This pattern may hold if tariff-driven dollar softness persists.

Longer-term, a fractured global currency system could elevate Bitcoin’s role. Historically, the dollar’s stability made it the default for international trade. If confidence erodes, entities may seek alternatives like gold or Bitcoin. The latter’s fixed supply and decentralized nature position it as a potential hedge against currency volatility.

Bitcoin’s Unique Value Proposition

Unlike gold, Bitcoin is portable, divisible, and digitally native—traits suited for a globalized economy. Its scarcity (capped at 21 million coins) contrasts with fiat currencies, which governments can print indefinitely. As Miran’s speech hints at systemic recalibration, Bitcoin’s appeal as a non-sovereign asset grows.

Bitwise, forecasts Bitcoin reaching $200,000 by year-end. While speculative, this aligns with scenarios where macroeconomic shifts drive demand for hard assets.

In times of flux, assets divorced from political agendas gain relevance. Bitcoin, built for an era of digital interdependence, may prove its resilience as old systems adapt—or falter.

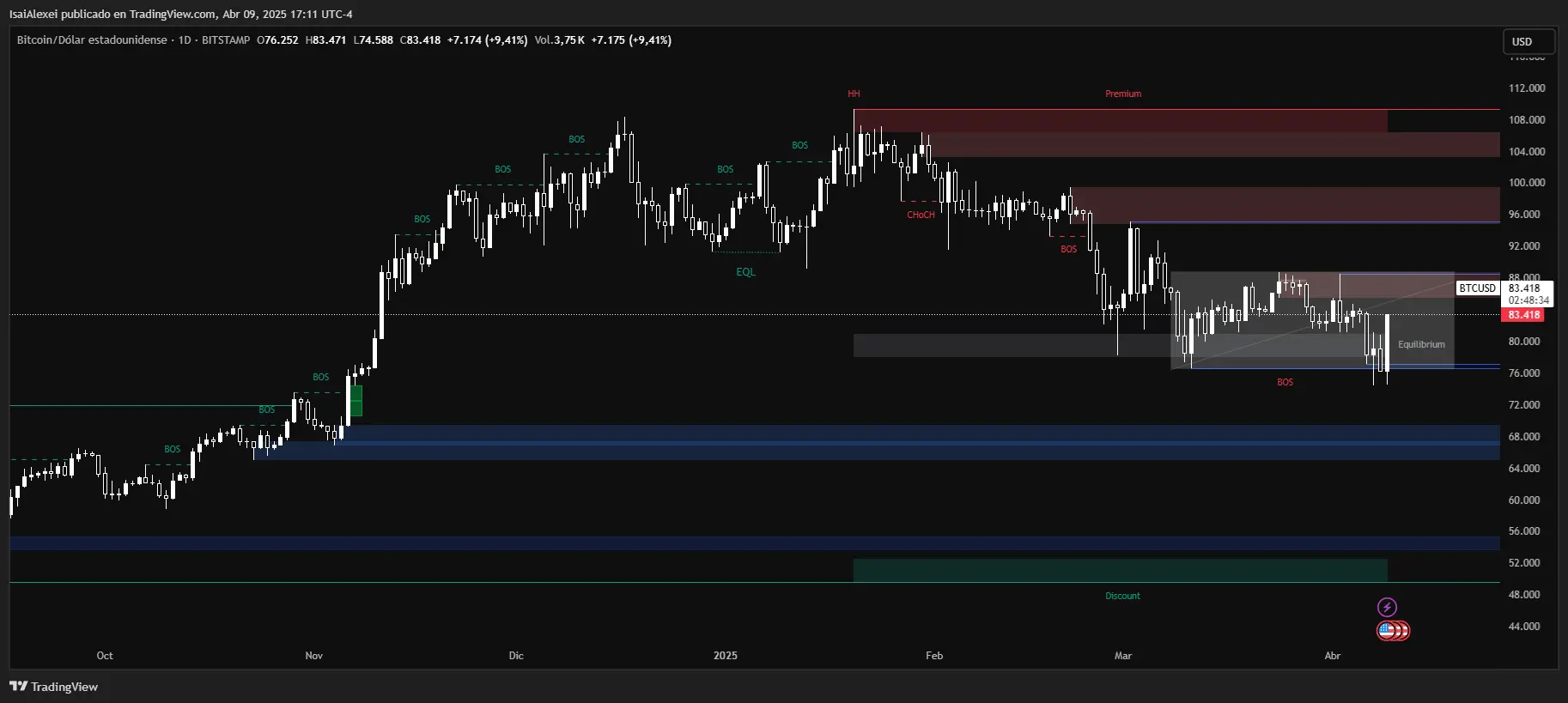

As of the most recent update, Bitcoin (BTC) is trading at approximately $82,971, showing a strong daily surge of over 8.8%. This significant price movement follows a rebound from a previous dip below the $75,000 level, demonstrating renewed bullish momentum.

Despite recent short-term corrections, the broader trend remains resilient with a 37.52% increase over the past six months, although it’s still down 11.2% year-to-date. Key resistance levels have shifted, and BTC has broken through previous ceilings, signaling potential for continued upward movement if the momentum sustains.

Technical indicators show a neutral overall stance, with oscillators and moving averages mixed—some pointing toward buy signals and others reflecting cautious consolidation. Analysts have noted the potential for further gains, especially considering institutional accumulation, whale activity, and long-term holder confidence.

With realized capitalization soaring from $20 billion in 2023 to $160 billion in 2025, Bitcoin appears fundamentally strong. However, some voices in the market warn of a possible retracement to the $70K–$75K area, or even lower to $60K, before a stronger long-term rally materializes.

Comments

You need to be logged in to comment

No comments yet. Be the first to comment!

Need a website?

Then contact us for professional web development services.

Table of Contents

Share this article

More from the blog

Microsoft’s August 2025 Windows Update Is Breaking Streaming and Raising SSD Fears

Meta Description: Microsoft’s August 2025 Windows update (KB5063878 / KB5063709) is causing major problems for streamers and sparking SSD concerns. Here’s what went wrong, Microsoft’s slow response, an...

Microsoft Zero-Day Bug Exploit: How It Happened and What You Need to Do

Imagine waking up to the news that hackers have a secret key to your company’s data. That’s exactly what happened in July 2025 when a zero-day bug in Microsoft SharePoint was discovered to be under act...

Dembele, Yamal or Salah? Breaking Down the Bookies’ Picks for Ballon d’Or 2025

The Ballon d’Or trophy stands as the pinnacle of individual achievement in football – the gleaming prize that will be awarded on September 22, 2025. After a season of drama (Paris Saint-Germain clinch...