Trump enacts 90-day universal 10% tariff pause for most nations, raises China rate to 125%

Bubbles

April 9, 2025

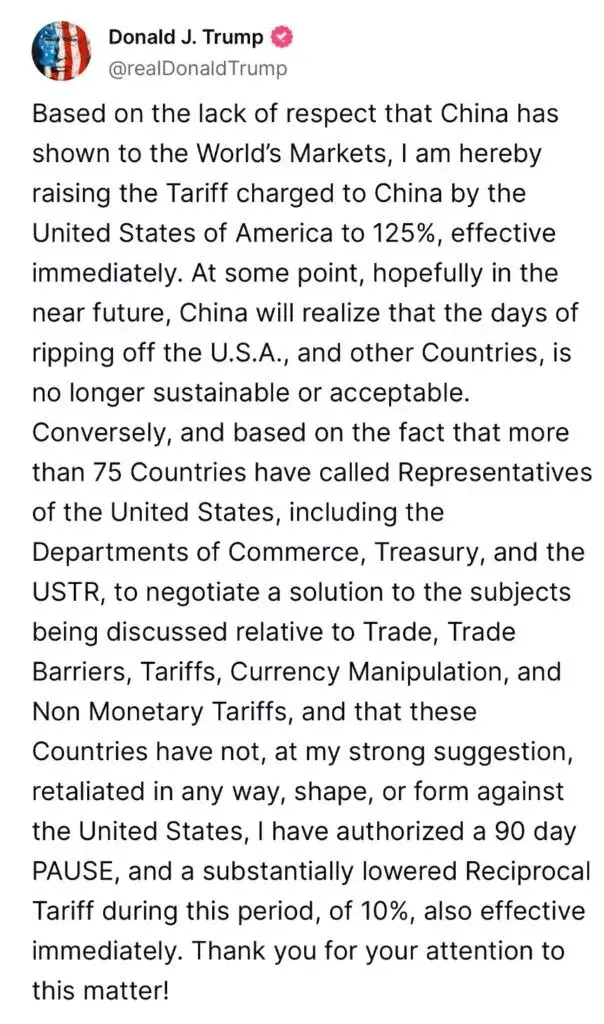

President Donald Trump has imposed a sharp increase in tariffs on Chinese goods, raising the rate to 125%, while offering a 90-day pause with a uniform 10% tariff for over 75 other nations currently engaged in trade negotiations with the United States.

The White House clarified the policy on 9 April 2025, stating the lowered tariff for most countries would be effective immediately, while China’s new rate reflects what Trump described as “the lack of respect that China has shown to the World’s Markets.”

This escalation follows Beijing’s own retaliatory move. On 10 April 2025, China will raise tariffs on U.S. imports from 34% to 84%, citing the Trump administration’s earlier introduction of a sweeping 54% tariff on Chinese goods under a new “reciprocal” tariff regime.

According to China’s Ministry of Finance, the measure—approved by the State Council—adheres to national laws and the “basic principles of international law.”

In a strongly worded statement, Chinese authorities described the U.S. tariffs as “a mistake upon a mistake” and labelled them “unilateralism, protectionism, and economic bullying.”

The Chinese State Council Tariff Commission warned that the U.S. policy “seriously damages the multilateral trading system” and infringes on China’s legitimate trade rights.

The tensions began on 5 April 2025, when the Trump administration enacted a baseline 10% tariff on all imports. This formed the foundation of a tiered tariff system targeting countries accused of unfair practices. Under this model, nations such as Vietnam, Cambodia, Thailand, and Taiwan face rates between 32% and 49%, while China was initially hit with the maximum 54%.

On 2 April 2025, Trump had introduced the system as a declaration of “economic independence,” framing it as a fundamental shift in U.S. trade policy.

In his latest Truth Social post, Trump stated he had authorised a 90-day pause on tariff increases for countries that had reached out “to negotiate a solution” and had refrained from retaliation. These countries will see their tariff rates dropped to a uniform 10%.

However, China remains excluded due to its retaliatory posture and what Trump termed its ongoing exploitation of global markets.

“At some point, hopefully in the near future, China will realize that the days of ripping off the U.S.A., and other countries, is no longer sustainable or acceptable,” he wrote.

Trump added that his move was based on outreach from more than 75 nations and praised their restraint in not enacting countermeasures. He called the lowered tariffs a “gesture of good faith” during the ongoing discussions.

Despite previous comments rejecting any pause, Trump’s sudden policy shift came as economic concerns mounted. In recent days, JPMorgan CEO Jamie Dimon warned of a likely recession if tariffs continued to escalate. Trump acknowledged watching Dimon’s interview, calling him “very smart” and noting he agreed something had to be done about trade.

Canada and Mexico remain exempt from the new 10% tariff, according to a White House official. Their current arrangements under the USMCA continue to apply, with a 25% rate on non-covered goods.

Markets erupted in one of the most significant rallies in modern history following Trump’s tariff pause announcement.

The S&P 500 soared 9.52% to close at 5,456.90, marking its biggest one-day gain since 2008 and the third-largest since World War II.

The Dow Jones Industrial Average surged 2,962.86 points, or 7.87%, to end at 40,608.45. The Nasdaq Composite jumped 12.16% to finish at 17,124.97, its second-best day on record.

Over 30 billion shares changed hands, making it the busiest trading day on Wall Street in 18 years, according to historical data.

The explosive rally came just moments after Trump’s post on Truth Social announcing a 90-day tariff pause for most countries and an increase to 125% for Chinese goods. The announcement was published at 1:18 p.m. Eastern Time. The Dow was already trending higher by 350 points but spiked more than 2,000 points within minutes of the post.

Treasury Secretary Scott Bessent later clarified that all countries except China would be subject to a 10% baseline tariff during the negotiation period. Sector-specific tariffs would remain in effect, he noted.

Investor sentiment, which had been battered by a four-day rout triggered by escalating tariff tensions, turned sharply.

Shares of companies most exposed to trade war risks surged. Apple rose over 15%, Nvidia by nearly 19%, and Tesla led the day’s rebound with a 22% gain. Walmart advanced 9.6%.

“This allows for at least a near-term rally, but I would not assume that the bottom has been put in place,” said Sam Stovall, chief investment strategist at CFRA Research.

Adam Crisafulli, founder of Vital Knowledge, added, “Given how depressed stock prices and sentiment had become, the 90-day pause is sparking a violent rebound.”

President Trump told reporters later in the day that investors had overreacted to the tariff rollout. “I thought that people were jumping a little bit out of line. They were getting yippy,” he said.

The rally marked a sharp reversal from the prior week, during which the Dow fell over 4,500 points and the S&P 500 and Nasdaq sustained double-digit declines—the worst such slide since the pandemic years.

Comments

You need to be logged in to comment

No comments yet. Be the first to comment!

Need a website?

Then contact us for professional web development services.

Table of Contents

Share this article

More from the blog

Microsoft’s August 2025 Windows Update Is Breaking Streaming and Raising SSD Fears

Meta Description: Microsoft’s August 2025 Windows update (KB5063878 / KB5063709) is causing major problems for streamers and sparking SSD concerns. Here’s what went wrong, Microsoft’s slow response, an...

Microsoft Zero-Day Bug Exploit: How It Happened and What You Need to Do

Imagine waking up to the news that hackers have a secret key to your company’s data. That’s exactly what happened in July 2025 when a zero-day bug in Microsoft SharePoint was discovered to be under act...

Dembele, Yamal or Salah? Breaking Down the Bookies’ Picks for Ballon d’Or 2025

The Ballon d’Or trophy stands as the pinnacle of individual achievement in football – the gleaming prize that will be awarded on September 22, 2025. After a season of drama (Paris Saint-Germain clinch...